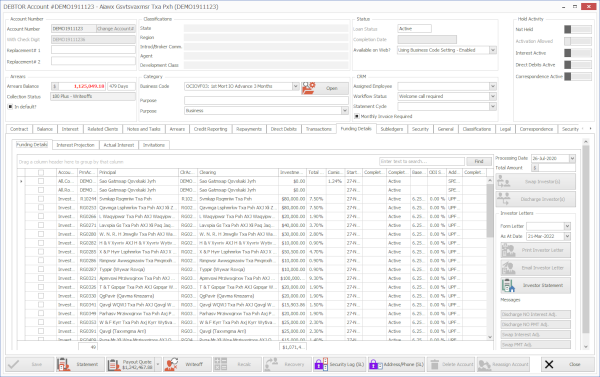

Contributory Mortgages - Funds Management

A contributory mortgage is a mortgage directly funded by an investor or Investors. The performance of the mortgage dictates the payment of interest distribution to the linked investors.

Funding

A mortgage can be funded by one or many investors

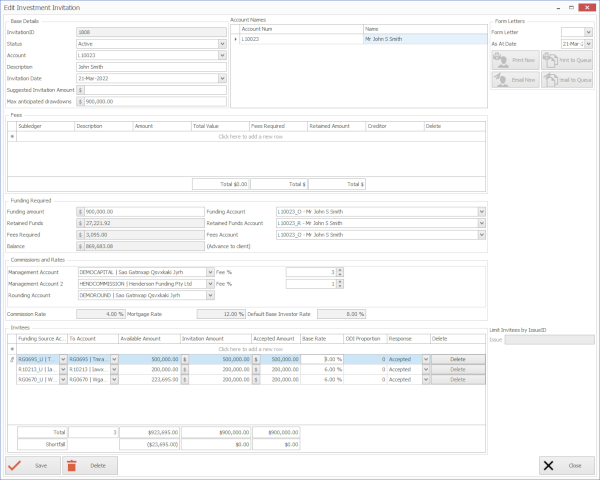

Invitation to Invest

All mortgages are funding via an Invitation to invest. This can either be just a formality or part of the actual process in funding a mortgage. Each investor which will be funding the mortgage is added to the mortgage via the invitation. The invitation sets the amount invested, the rate to be earned and any higher interest distribution applicable.

Processing an invitation moves the Investor funds from their Available funds account to their Primary linked Investment account.

Investor Interest

- Each investor can earn a different interest rate if required.

- The maximum interest rate an investor can earn is the Mortgage rate less any commission(s) deducted

- The minimum rate and investor can earn is any rate less than or equal to the maximum interest rate

- Generated to the Investors when

- Charged to the mortgage or

- When paid by the mortgage holder. When investor interest is generated by the payment of the mortgage interest. Both the Interest credit and debit are generated to the investor on this date.

Investor Interest Payments

- Payments of Investor interest are dictated and generated by the payment of the mortgage interest

- Investor interest payments can be forced by a business contribution to the mortgage account. Any business contribution is repaid when the next mortgage payment is applied. Any outstanding business contribution is repaid before any new Investor interest payments are generated.

Swaps and Discharges of Investors

- Investors can be swapped in and out at any time during the term of the mortgage.

- Investors can be discharged at any time during the term of the mortgage.

- Adjusting entries can be generated for interest and or payments already made if required.

Commissions earned

- There can be a maximum of two commission accounts linked to the mortgage. The rate of commission determines the maximum rate available to the investors.

Mortgage Interest

Interest can be charge - In arrears and - In advance. When Interest In arrears – interest cycles - anniversary and - month end cycles are available When Interest in advance – Interest cycles - anniversary day - month end and - fixed day each month

Mortgage Interest Calculation

Pro rata – part periods - Smoothed interest - Actual interest Standard - full period - Smoothed Interest - Actual Interest

Higher Mortgage Interest charge

A higher interest charge can be generated as a separate charge to the standard interest charge when the mortgage account is in arrears. The higher charge can be split, if required, between the company and the investors.

If the higher charge is to be split among the investors the split to each is defined as a fixed percentage of the total charge. The minimum split to any investor is 0% and the maximum is 100%. As an example, if the higher charge was to be split equally between the company and nine investors linked to the mortgage. The split rate would be set at 10% for each investor. If the higher interest charge for the month was $1200.00. Each investor and the company would each receive $120.00 in additional interest for the period.

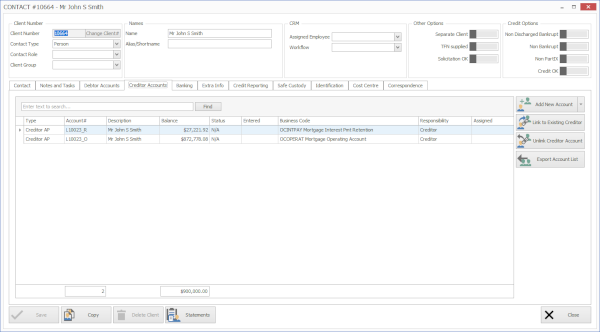

Tracking funds

As part of the invitation process funds can be automatically posted to relevant creditor accounts. This can include funds to be disbursed to the mortgage holder as well as funds to be retained for payment of interest and fees.

Creditor accounts linked to the mortgage holding the balance of funds to be disbursed and to be used for paying ongoing fees and interest.

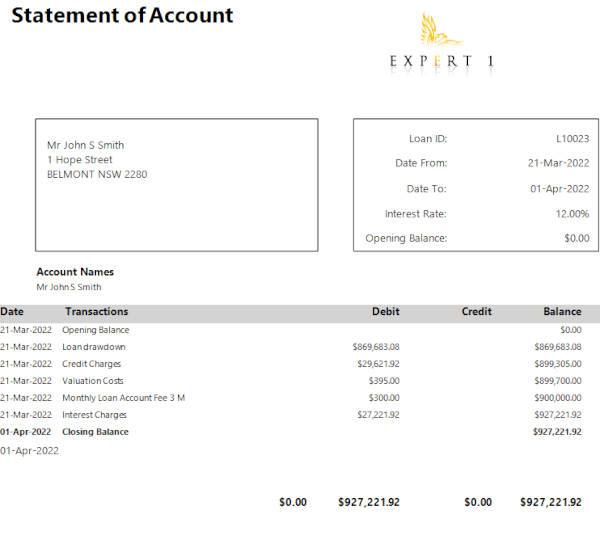

Statements

A mortgage statement can be generated at any time during the life of the mortgage account.

An investor statement can be generated at any time during the life of the mortgage account. It shows the amount invested by the investor along with the interest received and paid.

Mortgage Statement

Investor Statement