Overview

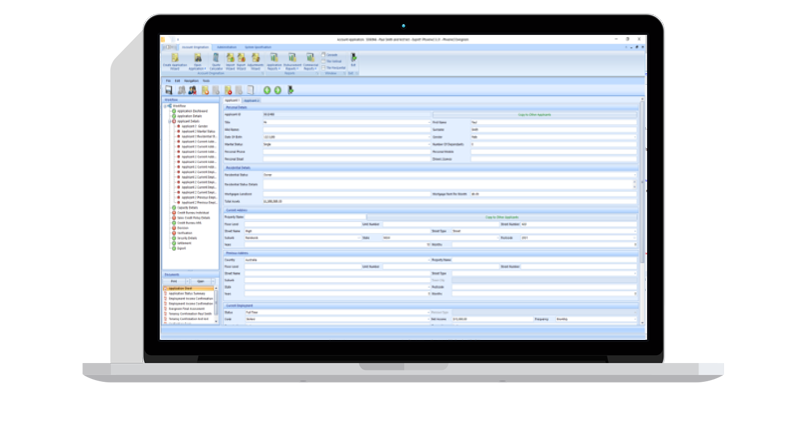

Phoenix manages every aspect of your business, including:

- Capturing Loan Applications

- Data checking

- Scoring

- Credit Check

- Loan Acceptance

- Disbursement

Technical Requirements

- SQL Server 2017 (express edition can be used).

- Microsoft .Net Framework 4

- Phoenix can be run in a terminal services environment.

Key System Features

A New Way of Building Systems

Most software that you buy today is a “black box” that contains all the logic that the programmer thinks you need to run your business. The problem with the “black box” approach is that you rely on the programmer to “get it right” when he writes the program. Systems written this way are difficult to change, difficult to fine-tune to suit your needs, and cost you lots of money to maintain.

Phoenix LO is different. Rather than taking the “black box” approach, we use flexible “plug-ins” or “logical building blocks” to craft a system. Each plug-in is easy to change. If you wanted to, you could change them yourself, or even create your own.

If you don’t like the way a screen appears, it’s easy to change the layout, prompts, fields, validation methods, etc.

What this means for you is lower maintenance costs, a more reliable system, and software that can easily adapt to your changing business needs.

At the heart of Phoenix LO is a powerful “Business Rule Engine”. This lets you build rules for your business in natural language. You make the rules, and Phoenix enforces them. If your needs change, all you have to do is change the rules, and let the Business Rule Engine do the rest.

Data-Capture

Agent Data-Capture. Your agents can download a restricted data-capture utility from your web site. This allows them to enter loan applications from their computer, and submit them to you. Since the data is scored, checked and vetted by the system before it is accepted, this minimizes the amount of time that you need to spend entering the information yourself.

Web-Service Data-Capture. Your agents may have their own data-capture program. The Phoenix Web-Service facility allows them to send data directly to Phoenix from their own system – web page or internal program. This saves you time since you don’t have to key the data yourself, but it also saves your agent’s time since they can continue to use their existing software, and don’t need to invest time in learning new programs. Their existing software can be easily modified to send data to your web services. We provide easy to follow instructions on how to do this.

Fax / Email Data-Capture. Applications that are faxed or emailed to your office can be captured by Phoenix LO and placed in a queue. Your operators can then use a Phoenix plug-in that lets them view the faxed application form on one side of the screen while they key the data into the other half of the screen. Having the fax-image side-by-side with the data-entry form saves you time since it minimizes the errors that are made during data-entry and makes it easier for your operators to enter loan applications.

Please contact us if you would like us to give you a proposal to provide these additional data capture facilities

Data Checking

We use flexible screen layouts that have dynamic built in editors. Each editor allows you to control exactly what data can be entered by the operator. You can adjust each editor to suit the type of data you want to be entered. The decision engine can perform custom calculations/manipulation on data entered, which gives you very tight control over the data that gets entered into your system.

We also have a postcode control that automates data entry based on postcode data. This control does however rely on data being provided. In some countries this data is free. In others this data would need to be purchased from the relevant government authority.

Scoring

Phoenix Credit Policy and Scoring

Phoenix - Rules set in system

Our decision engine records a decision flow (decision tree) based on the rules built for a scorecard or credit policy. The decision tree is then presented back to the user in an easy to understand format.

Rules within the decision engine can be altered using natural language (e.g. “IF the applicant that has more than one default THEN reject the application”, “IF the applicant is younger than 29 THEN reduce the credit score by 10 points”, “IF the applicant lives in a high-risk area THEN refer the application for a manual decision”). The natural language hides complex coding rules using aliases. These aliases are a natural language representation of the logic that is executed as part of a rule.

Workflow

Phoenix LO prepares your documents, contracts and other paperwork, and ensures that all steps are carried out in the correct order so that the process complies with the rules of your business. Data can then be exported to the Tango 32 system.

Credit Check

Phoenix Credit Bureau Integration

Phoenix - Intergrated with Credit Bureau (Baycorp)

One of the components of Phoenix LO is a credit bureau plug-in which can communicate with a variety of different Credit Bureaus. At present it is able to exchange information with Experian UK, Experian Italy, Baycorp Australia and Baycorp New Zealand, but this list is continually growing. The data is downloaded from the bureau in a few seconds – as part of the workflow process. Information from the bureau can then be used immediately within the decision engine which lets you make rapid credit policy decisions.

Acceptance

Loan acceptance (decisions) are be made via the decision plug-in. You view the results of the credit policy that were enforced by the decision engine. You can then accept or override the automatic decision.

Disbursement

Phoenix contains an easy to configure calculator that works out financial information, repayments, commissions, taxes etc.

Completed loans are automatically added to the Tango 32 loan management system using our export plug-in. This plug-in communicates with a variety of loan management systems. Part of this interface includes the ability to automatically generate account numbers that meet your needs, such as prefixing the account code with several alphabetic-characters to identify the relevant product.

Phoenix - Online Web Applications System

Features

- Plugs Directly Into Phoenix

- Customisable

- Customers can Apply For Loans Online

- Uses the existing rules from Phoenix

- Fully intergrated with Phoenix Loan Origination

- No need to Import/Export data (Uses same Database)